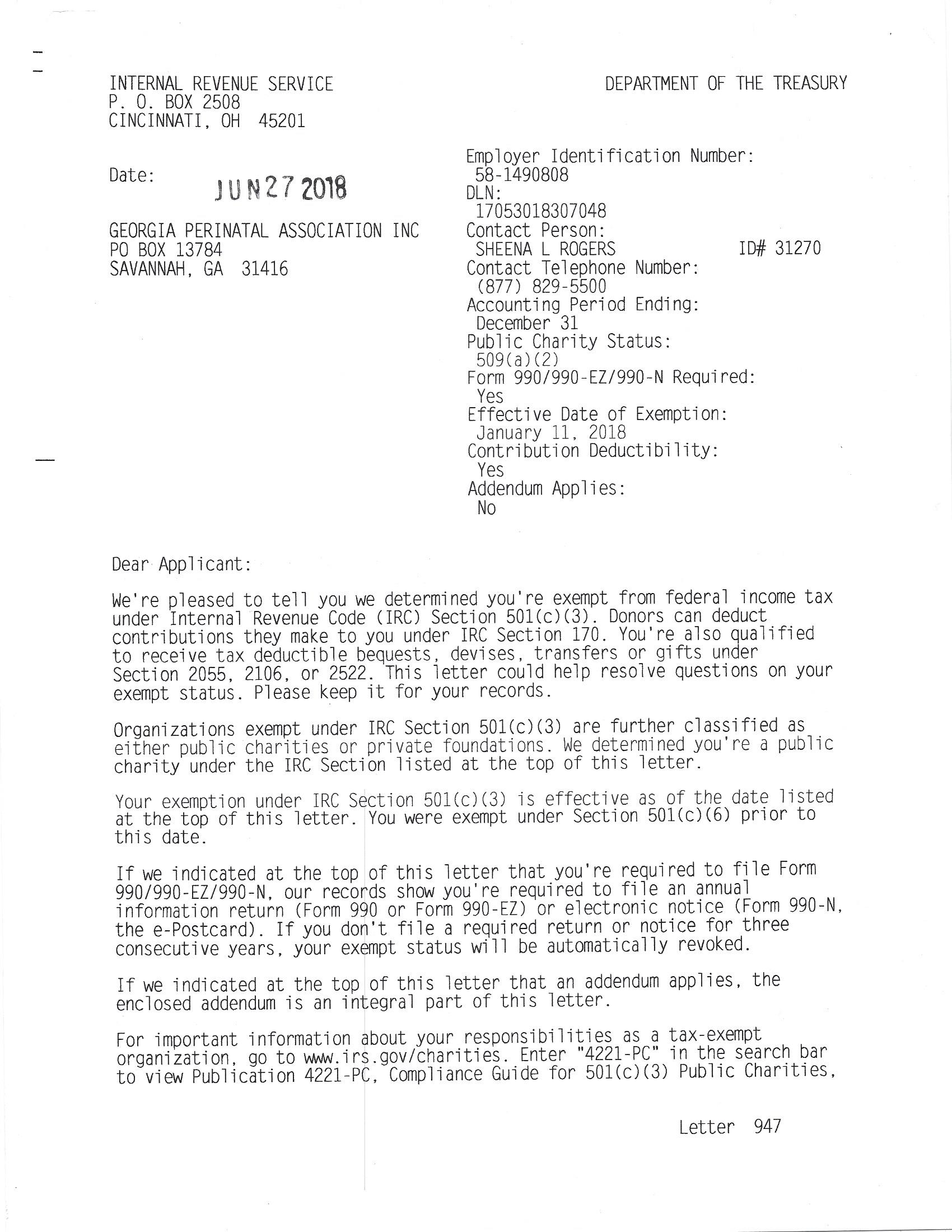

GPA’s tax classification has changed in to benefit our members, partners and donors. The organization has always been a “non-profit” tax-exempt group as a 501(c)(6) (“trade association” per IRS definition.)

GPA is officially a 501(c)(3) tax-exempt charitable organization.

What does this mean for GPA members, sponsors, speakers and exhibitors?

Membership dues, contributions (think “silent auction”), sponsorships and other donations are ALL tax exempt.

What does this mean for GPA?

It offers GPA an unprecedented opportunity to seek donations, grants, and other forms of financial support that will benefit both GPA and donors.